How Loyalty Enables Your Brand’s Digital Transformation

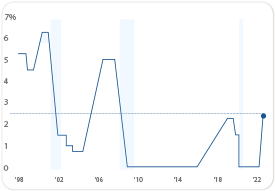

We may be in a better place when it comes to dealing with the COVID-19 pandemic, but financial gurus and strategists suggest we’re far from safe when it comes to a global economic recession. Since World War II, the U.S. has experienced 12 recessions, according to the National Bureau of Economic Research (NBER). The need for building a recession-proof brand is more now than ever before.

According to the latest Bloomberg survey of economists, the probability of a recession leading into 2024 is now 30%, the highest since 2020. Fox Business also warns of an impending recession.

Inflation has risen to levels we haven’t seen for nearly 40 years. McKinsey & Company reports some 60% of advanced economies are challenged with year-on-year inflation above 5%. According to independentretailer.com, the cost of nearly every product and service is at its highest level since 1981, slowing sales for brands globally.

With regards to current geopolitical conflicts, Bill Gates warns, “It’s likely to accelerate the inflationary problems that rich world economies have and force an increase in interest rates that eventually will result in an economic slowdown.” Across the world, stock markets are in a free-fall. The Financial Express recently reported the global crypto market cap has shrunk to $1.54 trillion, decreasing by 2.28% in the last 24 hours, according to CoinMarketCap data.

While spending has been strong, consumers are noticing the difference. McKinsey & Company reports 90% of consumers are feeling inflation in groceries and gas the most, but it’s impacting all categories. And their purchasing decisions are largely based on where they can get the best value.

Federal economists have lowered growth projections. For the first time since 2018, the Federal Reserve has raised federal interest rates—and suggested the federal funds rate could climb. According to Wall Street economic analysts, the Federal Reserve’s move to raise interest rates as a way to beat inflation is a sign we’re on the verge of a financial crisis.

In a recent survey conducted by CNBC and SurveyMonkey Small Business Survey, 38% of business owners say inflation is their main cause of concern, followed by supply chain interruptions and labor shortages. The ongoing war between Russia and Ukraine could trigger a global economic recession impacting energy, commodity trade, travel, transport, automotive and service industries.

We’re hearing caution and cut backs are dominating CMO conversations. While it seems logical to reduce budgets during a downturn, too often marketing gets hit the hardest.

According to Forbes, the worst thing any brand can do in times of uncertainty is go radio silent. Your customers rely on you and if you’re not constantly educating, updating, and serving them during uncertain times, they likely seek a replacement.

Building and maintaining a brand your customers trust remains one of the best ways to reduce business risk. A study of the 2008 Great Recession, published by the International Journal of Business and Social Science, concluded that “companies that are able to maintain and even increase their marketing budget/spend during a recession experience growth in their sales figures and market share during and after recession.”

“Companies that are able to maintain and even increase their marketing budget/spend during a recession experience growth in their sales figures and market share during and after recession.”

The reality is, consumers are scrutinizing where and how they spend their money more than ever, and you should be doing the same. While containing costs is essential, failing to support your relationships with existing customers will jeopardize your performance over the long term.

Where does loyalty fall on your priority list? It may seem logical to de-prioritize your loyalty program—but the reality is it’s exactly what your customers need from you right now. So, instead of scaling back on loyalty and customer retention, we would argue now is the time to do the opposite. History has proven that loyalty programs are more beneficial during financial crises, as they help retain your current customers. A consistent brand presence is critical to keeping and increasing customer loyalty.

Now’s the time to strengthen the foundations of your business strategy to ensure your brand comes out of the recession stronger and wiser. There are four distinguishable approaches most businesses adopt in times of financial or economic crisis:

Most companies go into a defensive mode during difficult times. Without in-depth analysis and introspection, these companies immediately take preventative measures to safeguard the brand’s interest. There’s nothing wrong with taking preventative measures, but it’s extremely important to first understand the breadth and depth of the crisis as well as your company’s current market position.

Some companies adopt a marketing-focused approach, seeing a financial crisis as an opportunity to outrun their competitors. Kellogg’s and HP are famous examples of this approach. Sure, it’s a great opportunity to expand your market reach but as a brand you need to be mindful of the situation and consider consumers’ financial position.

A practical approach dictates that you analyze the situation, trust your goodwill, and take necessary steps to remain afloat. This guide is full of practical tips on using data, insights, and fresh informed marketing and loyalty strategies to move forward in the right direction.

A progressive approach involves thinking ahead and investing in your biggest assets—a major one being your customers. Your customers are the anchor that will keep your brand standing tall in the face of a financial crisis. That means you need an effective strategy for putting a fence around them and ensuring they stay loyal to your brand versus jumping to competitors.

The practical and progressive approaches are the most effective strategies adopted by winning brands and companies.

McKinsey & Company reports that, in today’s uncertain economy, consumers are wondering what’s to come, shopping around more, still expecting omnichannel experiences, and looking at brands differently. Consumers want to know these things about the brands they engage with:

An effective loyalty program provides invaluable customer data to enable your brand to anticipate what your customers need, understand what they buy and why they buy it. It also helps you identify where you can add value across the entire customer journey and, specifically what type of value your customers would appreciate the most.

In McKinsey & Company’s Navigating Inflation: A New Playbook for CEOs, they position the recession as an opportunity for CEOs to reframe customer relationships strategically by viewing repricing as an opportunity to forge deeper relationships with customers—exactly what an effective loyalty program is designed to do. Brands can start by answering these questions:

Today’s loyalty programs have the flexibility to offer a wide range of rewards, not just discounts and coupons. You can reward loyalty members for downloading your app, sharing on social media, participating in surveys or contests, and referring others. Pretty much any non-transactional behavior you can track, you can reward. And the more that members build these behaviors and see how they’re being accrued, the more likely they are to return again and again.

Your loyalty program creates a mutual value exchange. Your customers willingly share their data in exchange for you using that data to deliver a unique, personalized experience based on their specific needs, behaviors and lifestyle. Push your customers’ data across your tech stack, no matter what email, SMS, CRM, POS, CDP or CX platform you use, and engage customers across their entire journey. Continuously remind them of why they keep choosing you.

Can analytics help us personalize more effectively?

Annex Cloud’s Loyalty Experience Platform™ enables brands to collect unique zero- and first-party customer data, build a unified customer profile, push this data across your tech stack and personalize every interaction. It also allows you to segment and target by virtually any combination of attributes to optimize your marketing campaign performance.

A Harvard Business Review (HBR) article about understanding recession psychology offers some important insights to help brands more effectively segment their customers and craft the right messaging during an economic downturn. The article points out that, while marketers typically segment according to demographics or lifestyle, it may be more effective during a recession to look at consumers’ emotional and psychological reactions during the recession. HBR outlines four key segments to consider:

These consumers feel the most vulnerable and hardest hit financially, reducing all spending by eliminating, postponing, decreasing, or substituting purchases.

These consumers feel secure about riding out the bumps in the economy, consume at nearly the same levels, but are more selective about their purchases.

These consumers are typically the largest segment and are more resilient and optimistic about the long term but less confident about near-term recovery or their ability to maintain their standard of living. They economize, but less aggressively.

These consumers carry on as usual, and respond primarily by extending purchase timetables. They typically don’t change their purchase behavior unless they become unemployed.

Across segments, consumers prioritize and sort products and services into the following four categories:

| 1. Essentials Necessary for survival or perceived as central to their well-being | 2. Treats Indulgences they can justify for immediate purchase |

| 3. Eventual Needs, but those which can be put off indefinitely | 4. Expendables Perceived as unnecessary or unjustifiable |

Understanding these segments and categories can help you target and communicate more effectively. For example, Walmart aggressively used its everyday low prices policy in the 2001 recession. Crest focused on fortifying its emotional connection with customers during the 2008 Christmas season, tugging at customers’ heartstrings with spots for its Whitestrips product centered on the theme “I’ll Be Home for Christmas”.

HBR urges companies to remember that during recessions, loyal customers are the primary, enduring source of cash flow and organic growth. Adopting a customer-centric mindset and putting your customers before profits and sales is a long-term business strategy that offers high ROI.

HBR cautions that companies shouldn’t panic and alter a brand’s fundamental proposition or positioning, potentially confusing and alienating loyal customers. On average, increases in marketing spending during a recession have boosted financial performance throughout the year following the recession.

They suggest the best course is stabilizing your brand and reminding consumers of how your brand helps them in their life. This worked effectively for diamond retailer after reducing its marketing budget early in 2008 in response to the grim economic outlook.

When research revealed diamonds represent enduring value to a majority of consumers, the company doubled its Christmas advertising spending, running brand awareness ads proclaiming, “Here’s to less,” and encouraging us to buy “fewer, better things” because “a diamond is forever.” Although Christmas sales softened, prices were stable and consumers’ desire to buy diamonds remained strong.

According to HBR, the goal during a recession isn’t necessarily to accelerate growth. It’s winning your customers’ trust and loyalty, so post-recession they’ll come to you first. They maintain the business case for customer loyalty holds true across industries and geographies.

Through cutting-edge CX technology, our partners at Concentrix help their clients own the future. That’s why we asked for their strategic perspective on the year ahead.

Michelle Borgese Greenberg

Principal, Integrated Loyalty Solutions, Concentrix Catalyst

Meg Tronquet

Principal, Integrated Loyalty Solutions, Concentrix Catalyst

When we talk to customers, even in normal times, we often hear, “does a brand care about me when I’m not buying something?”, and now is a prime time for brands to show they do care. With inflation on the rise, supply chain logistics out of whack, and whispers of recession in the air, recent reports tell us that customers aren’t spending like they were a few months ago. Now is the perfect time for brands to nurture their relationships with customers and show they care.

Loyalty-focused brands have a unique opportunity at this moment. Loyalty is about personalization—using the information that brands have worked so hard to capture via their membership programs and delivering personalized content back to members in useful and meaningful ways.

For our clients with loyalty programs, we’re coaching them to activate their personalization strategies to deliver helpful, practical and actionable information to members.

Loyalty members deserve, and need to receive, preferential treatment. Emails that teach members how to do things with the products you know they own. Publish members-only videos that help them get more value out of what they have. Create new rewards or bonus opportunities. Or even share something on-brand that simply makes them laugh. Whether monetary, educational, or discount-oriented, your program will stand out as one that knows and cares about its customers.

If a brand can activate their personalization strategy now and show that it can play a helpful role in its members’ lives, regardless of whether they’re purchasing now, they will build deeper, long-lasting relationships with members that will weather the economic storm; and will be top of mind when members are ready to purchase again.

In decades gone by, businesses have faced several unprecedented times, be it during the great depression of 1929, or the great recession between 2007-09, and emerged as winners. So, what do these successful companies have in common? How did these global brands face the great recession and other economic pitfalls to emerge as winners?

You guessed it—they looked to loyalty! Here’s a quick look at some big achievements in the loyalty industry that happened during recent downturns:

This iconic brand officially invented modern loyalty programs in 1929 by introducing the so-called “box tops” (redeemable coupons printed on product packages) during the Great Depression.

This airline revolutionized the loyalty industry with its Frequent Fliers program in 1981 during the 1980s recession. Today its’ simplified AAdvantage loyalty program gives members many ways to earn status, such as by flying, using an AAdvantage credit card, or spending on everyday activities with an Advantage partner.

This electronic components manufacturer used the 1990 recession to build customer loyalty. It increased its focus on quality and customer retention by interviewing customers weekly to check satisfaction.

Their efforts paid off, winning them a Baldrige Quality Award, increasing revenues by more than 50% and enabling the brand to outperform competitors for more than a decade.

While most banks didn’t fare well, Citigroup actually grew in assets during the 2008 recession. With a focus on customers, they worked on branding, offering quality services, and supporting community services which helped their brand story.

Today’s consumers are much more socially and environmentally conscious, and expect the brands they deal with to be the same. Your loyalty program can reward customers by contributing to their favorite charity.

During the 2008 recession, Starbucks’ new CEO made a bold and lifesaving move, shifting focus to their customers. Their new online customer portal, My Starbucks Idea, allowed customers to create a profile and contribute ideas about what they wanted from a Starbucks experience.

In doing so, the brand transformed the perception from expensive and detached to cool, caring, and value-added. Starbucks launched its widely successful loyalty program in April 2008 at the peak of the 2007-08 financial crisis. As of February 2022, Starbucks Rewards represented 53% of the spend in-store, an all-time high.

The truth is, companies that see loyalty diminish during recessions are ones that ignore their loyal customers during those times and just expect them to resume their normal buying behaviors when things recover.

During the 2001 recession, Saks Fifth Avenue implemented deep price cuts that brought in short-term revenue but undercut its luxury status for many longtime customers.

Neiman Marcus took the lead when the economy rebounded, and Saks sales were slow to recover. While reports show J.Crew as the first retailer to file for bankruptcy during the pandemic, the truth is they were struggling long before that.

Throughout the past several downturns, their gradual moves away from their original styles, increasing prices, and failure to move on along with their shoppers made them irrelevant, and they paid the ultimate price for not maintaining close customer bonds.

Bain & Company reports companies that thrive during a downturn share the following common characteristics.

They avoid deep discounting

Avoid the trap of chasing revenue by trying to appeal to every potential customer group and aggressively discounting. New customers attracted only by lower prices don’t often buy more when prices recover.

They focus on their best customers

Knowing who your best customers are, that is the customers your company can serve better than any competitor, is key. These customers may span a broad range of buyers, so it’s important to identify discrete customer segments based on their different needs, attitudes, and behaviors. Unique loyalty data is invaluable in providing these insights.

They identify the critical moments of truth

Bain & Company define critical moments of truth as those touchpoints that matter most and have the greatest potential to delight your customers. A loyalty program enables meaningful engagement across the customer journey, providing ongoing opportunities to ask, listen and learn what matters most to your customers. The next step is adapting your offers, promotions and rewards to your customers’ current needs.

The advantages of customer loyalty are more pronounced in a downturn. Why? It costs less to serve existing customers, they’re more likely to spend their money with companies they trust, they’re up to 70% more likely to buy again and they’re more likely to refer others to help you lay the foundation for growth when things turn around.

According to Bain & Company, the biggest changes in market share occur during downturns. And, companies focused on protecting and adding value to their most loyal and profitable customers are more likely to stabilize during tough times and grow when recovery hits. They recommend thinking strategically and knowing the answers to these questions:

As mentioned earlier in this guide, McKinsey & Company reports that consumers are sticking with brands that offer real value. A loyalty program uses unique first-party customer data to deliver relevant value and meaningful engagement across the entire customer journey, not just during a purchase. So, even in the midst of economic challenges, a sound loyalty strategy provides the opportunity to strengthen your relationships with your customers.

The goal is to create such a compelling value proposition that existing customers see the cost of changing to a competitor too high to consider. For example, airlines offering loyalty members upgrades, access to premium lounges, and other attractive benefits members aren’t willing to give up by flying with a different carrier.

Here are seven strategies that will position you for a strong recovery, with loyalty

at their core:

Consumers are looking for value more than ever. Loyalty’s mutual value exchange provides the foundation for win-win relationships where customers are happy to share their preferences and needs and brands use their data to deliver unique, relevant experiences. The brand-to-consumer relationship becomes more of a conversation between friends.

Loyalty leaders have distinct advantages during a downturn because they know who their best customers are and what’s most important to them, so they can deliver timely, relevant value-based experiences. According to Bain & Company, 80% of a company’s profits come from 20% of their best customers.

Loyalty provides the opportunity for frequent engagement. These communications can focus on demonstrating you truly understand them and what they’re dealing with, how you’re working to deliver value, and that ‘we’re in this together’. For example, credit card companies can alert customers when they’re close to exceeding their limits. Retailers can educate customers on how to shop smart and save. During previous recessions, supermarkets shared information about nutritious, low-cost meals.

The Digital Transformation Institute reports that 70% of consumers with high emotional engagement spend up to two times or more on brands they’re loyal to, 81% promote the brand to family and friends, 62% advocate for the brand on social networks.

Loyalty provides continual opportunities to engage and help customers, such as reminding them they have unused points, notifying them how they can easily reach the next level and what extra benefits they’ll receive, and sharing how they earn extra rewards. All of these communications help to create emotional engagement beyond transactions.

Emotional loyalty is more comprehensive than brand loyalty, encompassing more of the customer’s emotional profile and relationship with a brand. It’s the consistent, deep-rooted psychological attachment to a brand and based on the idea that consumers form strong emotional relationships with brands and are thereby influenced by their emotions.

While it takes work to achieve, it’s extremely profitable when you do. Certain factors like congruent brand image, great customer experience, feeling special and some others influence customers to develop emotional loyalty towards a brand. Dove has always strived to empower women and redefine beauty in a new light, thereby connecting on a deep emotional level with their target audience.

No wonder the philosophy behind Dove’s Real Beauty campaign is still going strong. The overall sales of Dove products jumped from $2.5 to $4 billion in the campaign’s first ten years.

Kelsey Robinson, Senior Partner at McKinsey & Company, suggests companies ask, “Who am I serving and how are they uniquely experiencing this inflationary environment?” She says it’s not a one-size-fits-all experience, so really understanding who you’re serving and what their day-to-day feels like is important. This is where unique loyalty data can be invaluable.

The best way to know what your customers want and expect is to ask them! Loyalty provides the opportunity for your brand to continually engage customers, collect additional information about their likes, preferences and expectations, and ask them to participate in surveys. This ensures your brand stays relevant and delivers the value your customers are looking for today and tomorrow.

Maintaining an unwavering focus on your best customers and investing in value-based loyalty are the best ways to drive advocacy. According to a study by Oberlo, 71% of customers that are satisfied with the brand they purchased from are likely to recommend it to others on social media. And KPMG reports that 86% of loyal consumers will recommend a brand to friends and family.

Zero- and first-party data collected through your loyalty program can provide the insights you need to make sure your communications, promotions and rewards resonate with your customers. An article from independentretailer.com suggests some possible strategies:

Offer double or triple points on more profitable products or products shoppers might delay until they have more disposable income. This can help you compete without lowering prices. Consider offering loyalty members sample-size free gifts with each purchase, increasing the likelihood they’ll opt for the full-size version later.

Offer bonus points for purchasing must-have items to ensure loyalty members look to you for their day-to-day items. Aside from promotions tied to transactions, your loyalty program provides you with the opportunity to keep customers engaged between purchases, and recognize and reward them for non-transactional behaviors, such as downloading your app, sharing on social media, referring others and more.

Offer additional points to loyalty members for buying bundled products to increase average order values. They’ll be more likely to purchase individual components as they run out.

Offer free returns to your top-tier loyalty members. This helps members feel the VIP treatment even when they’re not shopping as often and earning rewards less frequently.

Despite tighter wallets, we all want to celebrate special occasions, such as graduations, Mother’s Day and Fourth of July.

Your loyal customers count on you, and the last thing they need is for your brand to react or panic. Worried consumers look to their familiar, trusted brands as a safe and comforting choice in trying times. The moment you lose their trust, you’ll likely lose their business, too. Nine out of ten consumers will stop buying from a brand they no longer trust, and rewarding them for their loyalty is a far better investment than starting over with a new customer.

In the midst of an economic downturn, it’s good to deliver value, but it has to be the right value to ensure loyalty. Loyalty’s robust zero- and first-party data helps you make sure the value, rewards and benefits you deliver resonate with your customers.

Armed with loyalty data that includes transactions, behaviors, preferences and more, you can create personalized offers and rewards that really hit the mark. You can also see which offers and rewards are resonating the most and which may need to be re-visited.

According to HBR, it’s critical to track how consumers are reassessing priorities and budgets, switching products and redefining value. You can’t assume they’ll resume their old purchasing behaviors post-recession. Your loyalty program gives you endless opportunities to engage your customers, survey them and keep a pulse on their changing needs and preferences.

Today’s loyalty programs go way beyond earn and burn. When done right, they are the key to identifying your best customers, delivering personalized, timely and relevant experiences, adding value in every interaction (not just purchases), and recognizing and rewarding these customers. Loyalty’s mutual value exchange and value-based engagement create lasting emotional bonds that give your customers plenty of reasons to stay with you, no matter what economic challenges arise.

Here are a few brands that may inspire some ideas to try with your customers:

Lululemon

This Canadian athletic apparel retailer is acknowledging the economic climate and allowing customers to remain engaged with the brand by trading in or reselling gently used clothing.

IKEA

This multinational conglomerate selling ready-to-assemble furniture, appliances, and home accessories is a great example of a company making its customers’ lives easier. First, its products aren’t pre-assembled, resulting in lower prices and easy portability.

In addition, IKEA offers services completely unrelated to selling furniture to enhance the customer shopping experience, such as baby-sitting and putting restaurants in stores. Lastly, the company’s IKEA Family loyalty program provides a range of benefits to customers. Perks include special discounts, free items, and hosted workshops and events.

DSW

American designer shoes and accessories brand DSW revamped its loyalty program based on customer feedback. Unlike any fast-moving consumer product, designer shoes and accessories aren’t frequently purchased items. “Customers told us they wanted more, and they wanted it faster,” says Rich Clum, manager of marketing applications for Designer Brands, the company that owns the DSW brand.

The brand nurtures its community of loyal customers and provides them with exclusive offers based on customer attributes, purchase pattern, and preferences. This helps ensure DSW customers remain loyal and engaged to the brand and become part of the DSW community.

Delivering relevant, value-based experiences for your customers starts with clearly understanding their values, preferences and needs. Analyzing your loyalty data can help you paint a clear picture.

Management Consulting firm Propeller offers the following tips to get started:

All businesses lose customers but, especially during tough economic times, it’s important to know your churn rate to have a baseline of how many customers you lose during a given timeframe and why. This will help you identify if your efforts are moving the needle in the right direction.

Identify which customers have the highest customer lifetime value and offer exclusive benefits for top-tier loyalty members.

Do you know which touchpoints along your customer’s journey are most impacted by inflation and a recession? Do you know what their biggest challenges are right now? What new patterns of behavior are emerging? Surveys conducted as part of your loyalty program can provide helpful insights.

Forbes recommends taking the time to understand how your customers are reacting to, and spending, during these times. What habits are emerging? Where do consumers draw the line between categories? Collecting and analyzing loyalty customer data helps you identify if customers are adopting new purchase behaviors and preferences. Loyalty surveys can help you identify significant changes and inform new strategies.

Instead of strictly going for the next sale, aim to create a lasting emotional connection with your customers. This includes reminding them of the value you’re delivering.

Identify and target specific customer segments based on needs, behaviors, and preferences.

Loyalty programs have been boosting business growth and supporting brands through economic challenges for decades but some businesses still fail to see loyalty as a holistic business strategy that can do more than just drive purchases.

More than 90% of the companies worldwide have a loyalty program but most brands fail to leverage its maximum benefits. Consistent engagement and mutual value exchange between a brand and its customers is the foundation of a strong relationship that can sustain a business during the most difficult economic crises.

The economy will recover and, when it does, you want to be in a strong position to grow forward. Annex Cloud’s Loyalty Experience Platform offers the widest range of engagement modules to create lasting emotional bonds, implement surveys, drive advocacy and more. Our 125-plus integrations make it easy and fast to implement within any tech stack.